by Becca Frazier | Aug 9, 2022 | Uncategorized

Ag is long on work and short on labor, with over half of farmers saying they’ve faced labor shortages. Legislative needs and downstream impacts abound. Hired farmworkers make up over 1/3 of total hours worked on the farm. So, they’re a pretty big deal, second only to...

by Travis Martin | Jul 27, 2021 | Uncategorized

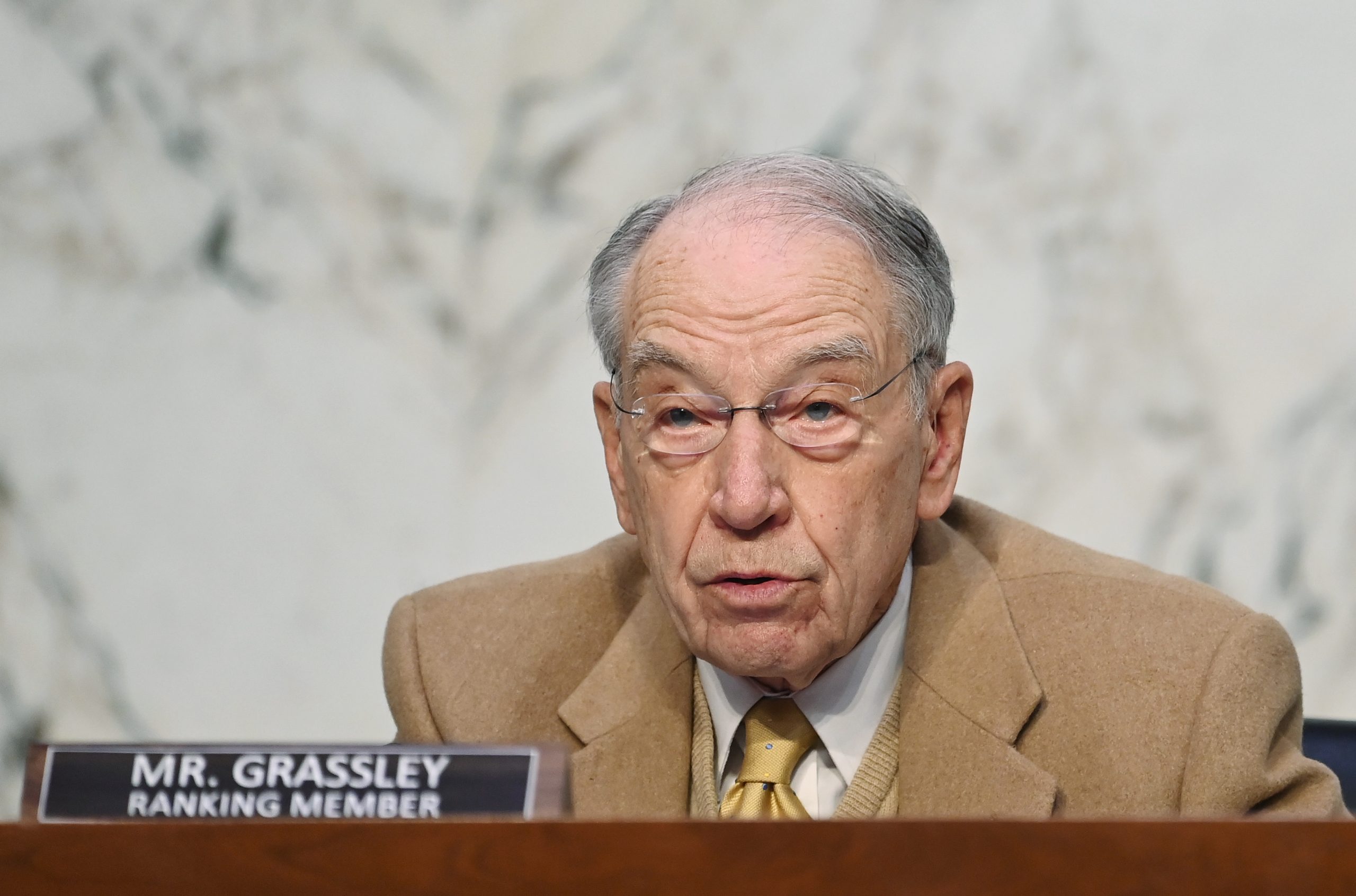

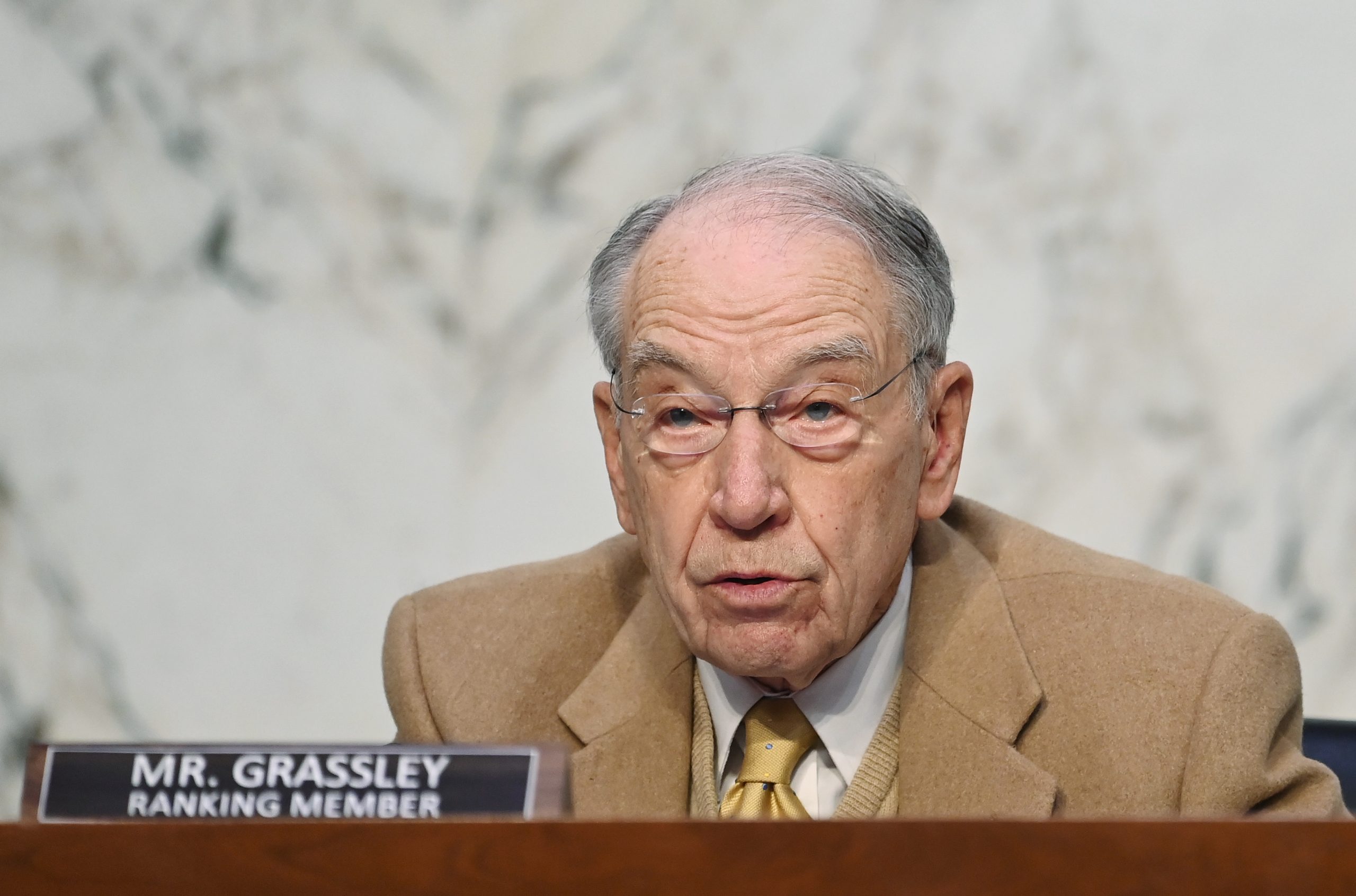

The struggle is real with the current U.S. labor shortage, and agriculture is certainly not excluded. The sector is feeling the squeeze, and legislators are pushing to reform the guest worker program to help. The issue at hand: the current H-2A guest worker program is...

by Travis Martin | Jun 8, 2021 | Uncategorized

Given the ‘help wanted’ signs we’re seeing everywhere, it’s no surprise that the ubiquitous labor shortage is squeezing the ag sector, too – with no signs of stopping. The USDA’s 2021 Farm Labor quarterly report was published with April data, and it isn’t...

by Travis Martin | Jan 22, 2021 | Uncategorized

Cargill might need an extra shot of espresso in its morning brew to tackle its to-do list these days. But that comes with the territory when you’re one of the largest privately-held companies in the U.S.Lots of industry news has Cargill’s name floating into headlines....

Recent Comments